Last Updated on January 14, 2026

As a regular user of digital banks and e-wallets here in the Philippines, I know the convenience a GCash Card offers. It’s truly a game-changer for cashless payments and ATM withdrawals. But let’s be honest, nothing’s more frustrating than when your GCash card is not working right when you need it most. I’ve had my share of those “Transaction Declined” moments, and trust me, it’s not fun.

If you’re reading this, chances are you’re facing a similar problem. Don’t worry, you’re not alone, and there’s usually a straightforward solution. In this comprehensive guide, I’ll walk you through the most common reasons why your GCash card might not be working and provide clear, actionable steps to get you back on track.

Contents

- 1 What You Need Before Troubleshooting Your GCash Card

- 2 Common Reasons Why Your GCash Card Is Not Working & How to Fix Them

- 2.1 1. Insufficient Balance in Your GCash Wallet

- 2.2 2. Incorrect PIN or Too Many Attempts

- 2.3 3. Card Not Activated or Linked to Your Account

- 2.4 4. Transaction Limits Exceeded

- 2.5 5. Merchant or ATM Acceptance Issues

- 2.6 6. GCash System Downtime or App Glitches

- 2.7 7. Using Your GCash Card Abroad (International Issues)

- 2.8 8. “GCash Card No Name” & Online Transactions

- 2.9 9. Card Damaged, Expired, or Reported Lost/Stolen

- 3 When to Contact GCash Customer Service

- 4 The Takeaway: Don’t Panic, Troubleshoot!

What You Need Before Troubleshooting Your GCash Card

Before we dive into the nitty-gritty, let’s make sure you have these essentials ready. From my own experience, having these details on hand can save you a lot of time and hassle when troubleshooting or contacting support:

- Your GCash Card: Obvious, but important!

- Your GCash Registered Mobile Number: The one linked to your account.

- Your GCash MPIN: Your 4-digit mobile PIN.

- Your GCash Card PIN: Your 6-digit PIN for ATM and POS transactions (different from MPIN).

- Sufficient GCash Wallet Balance: Always check first!

- Stable Internet Connection: For checking the app and contacting support.

- Your Valid ID: If you need to verify your account or make inquiries.

Common Reasons Why Your GCash Card Is Not Working & How to Fix Them

Let’s tackle the most frequent culprits behind a non-responsive GCash card. I’ll cover scenarios from my own encounters and what I’ve learned works best.

1. Insufficient Balance in Your GCash Wallet

This is often the simplest and most overlooked reason! Even if you think you have enough, a small difference in the final amount (due to fees, for example) can cause a decline.

- My Fix: Always double-check your GCash wallet balance *before* making a transaction. Open your GCash app and see your current balance on the dashboard.

- What to Do: If your balance is low, immediately cash in. You can do this via online bank transfer, remittance centers, or over-the-counter partners.

2. Incorrect PIN or Too Many Attempts

It’s easy to mix up your GCash MPIN (for app login/transactions) and your GCash Card PIN (for physical card use). Inputting the wrong 6-digit card PIN multiple times will lock your card for security reasons.

- My Fix: Take a deep breath and ensure you’re entering the correct 6-digit GCash Card PIN for ATM withdrawals or POS transactions.

- What to Do: If you’ve entered it incorrectly too many times (usually 3 attempts), your card will be temporarily locked. You’ll need to reset your GCash Card PIN via the GCash app.

- Open your GCash app.

- Go to the ‘Cards’ section.

- Select your GCash Card.

- Look for ‘Reset Card PIN’ or a similar option.

- Follow the prompts to create a new 6-digit PIN.

3. Card Not Activated or Linked to Your Account

If you’ve just received your new GCash card, it won’t work until it’s properly activated and linked to your GCash account. I’ve seen friends forget this crucial step!

- My Fix: Verify that your card is indeed linked.

- What to Do:

- Open your GCash app.

- Tap on ‘Cards’.

- You should see your GCash card listed. If not, tap ‘Link my Card’ or ‘Order a Card’ if you haven’t yet.

- Follow the on-screen instructions, entering the last 4 digits of your card and the virtual account number (found on the back).

4. Transaction Limits Exceeded

GCash has daily, weekly, and monthly transaction limits depending on your account verification status. This is especially common if you’re a basic or semi-verified user.

- My Fix: I regularly check my transaction history and remaining limits, especially for larger purchases.

- What to Do:

- Check your transaction limits within the GCash app (usually in ‘Profile’ > ‘Account Limits’).

- If you’ve hit your limit, you’ll need to wait for it to reset or consider upgrading your account to Fully Verified for higher limits.

5. Merchant or ATM Acceptance Issues

Even though GCash cards are powered by Mastercard or Visa, there are still instances where a specific merchant or ATM might not accept it.

- My Fix: If a transaction declines, always try another payment method or a different ATM if possible.

- What to Do:

- For Merchants: Confirm that the store accepts Mastercard/Visa or if their POS terminal is working correctly. Sometimes, it’s their system, not your card!

- For ATMs: Ensure the ATM displays the Mastercard or Visa logo. Some ATMs might be offline or have temporary issues. Try another ATM, preferably from a major bank.

6. GCash System Downtime or App Glitches

Like any digital service, GCash can experience system maintenance or temporary glitches. This might affect card transactions.

- My Fix: I always check GCash’s official social media pages (Facebook, X/Twitter) for announcements. They’re usually quick to post about system issues.

- What to Do:

- Check GCash Social Media: Look for official advisories.

- Restart Your GCash App: Force close the app and reopen it.

- Clear App Cache (Android): Go to your phone’s Settings > Apps > GCash > Storage > Clear Cache.

- Update App: Ensure your GCash app is updated to the latest version from Google Play Store or Apple App Store.

7. Using Your GCash Card Abroad (International Issues)

Using your GCash card abroad is fantastic, but it comes with its own set of potential hurdles. My GCash card declined once in Singapore, and it was a real head-scratcher until I realized what was happening.

- My Fix: Always ensure your GCash account is fully verified before traveling. Also, be aware of international roaming for OTPs.

- What to Do:

- Full Verification: Your GCash account MUST be Fully Verified to use the card for international transactions.

- International Roaming: Make sure your Philippine SIM card has international roaming enabled if you need to receive OTPs for transactions, or rely on Wi-Fi for app-based transactions.

- Merchant Type: While Mastercard/Visa are widely accepted, specific merchant categories or small vendors might not be equipped for international prepaid cards.

- Dynamic Currency Conversion (DCC): Sometimes merchants abroad will ask if you want to pay in PHP or local currency. Always choose the local currency to get a better exchange rate from GCash.

8. “GCash Card No Name” & Online Transactions

Some older GCash cards or even newer ones might not have your name embossed on the front. This is generally fine for physical swipe/tap transactions, but can be an issue for some online payments that require an exact name match.

- My Fix: For online transactions that require a name, I sometimes use “GCash User” or “Customer” if the field is mandatory and no other option is available. However, for critical payments, I use a card with my name.

- What to Do:

- Physical Transactions: A “no name” card should work fine for POS and ATM.

- Online Transactions: If an online merchant strictly requires a name and verifies it, your GCash card without a name might be declined. Consider using a different payment method for such cases. GCash has started issuing cards with names, so if you’re frequently encountering this, consider ordering a newer version if available.

9. Card Damaged, Expired, or Reported Lost/Stolen

Physical damage, an expired card, or one that has been reported compromised will obviously not work.

- My Fix: Regularly check your card’s expiration date. Keep it safe to avoid damage.

- What to Do:

- Check Expiry Date: It’s usually on the front or back of the card.

- Inspect for Damage: Look for visible cracks, chips, or demagnetized strips.

- Lost/Stolen: If you reported your card lost or stolen, it’s permanently blocked. You’ll need to order a replacement.

- Order a New Card: If expired or damaged, order a new GCash card through the app.

When to Contact GCash Customer Service

I’ve tried all the troubleshooting steps myself, but there are times when you just need professional help. If you’ve gone through the steps above and your GCash card is still not working, it’s time to reach out to GCash Customer Service.

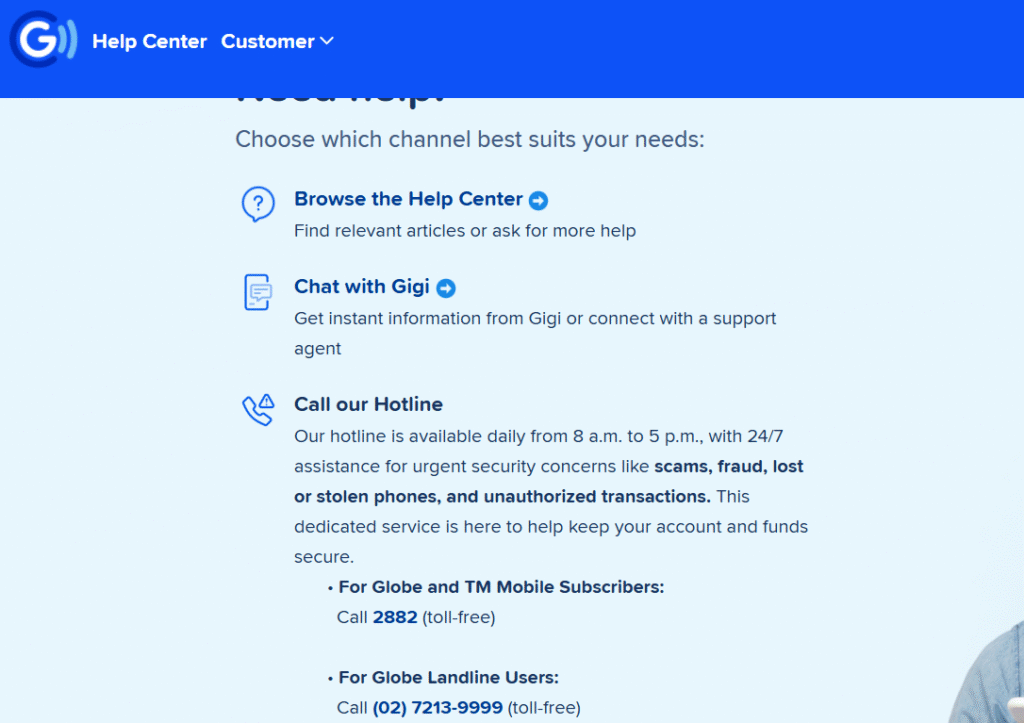

How to Contact GCash Customer Service:

- GCash Help Center in-app: The easiest way is usually through the GCash app’s Help Center. You can submit a ticket there.

- GCash Hotline: Dial 2882 using your Globe/TM mobile number (toll-free). For other networks, you can call their landline number listed on their official website. For urgent security concerns (like fraud or unauthorized transactions), their hotline is available 24/7.

- GCash Official Social Media: Send a direct message to their official Facebook or X (formerly Twitter) pages. Be wary of fake accounts.

When you contact them, be prepared to provide your GCash registered number, the date and time of the failed transaction, the exact error message (if any), and details of what you were trying to do.

FAQs: Quick Answers to Your GCash Card Queries

- Q: My GCash card was working before, but now it’s not. What changed?

- A: Check for recent app updates, review your transaction history for limits, or see if GCash has announced any system maintenance. Often, a minor update or temporary system glitch can cause unexpected issues.

- Q: Can I use my GCash card even if my account isn’t fully verified?

- A: While you can *order* a GCash card with a basic account, its full functionality, especially for international use and higher transaction limits, requires a Fully Verified GCash account. For consistent use, full verification is highly recommended.

- Q: Is my GCash Card PIN the same as my MPIN?

- A: No, they are different! Your MPIN is your 4-digit mobile personal identification number used for app transactions. Your GCash Card PIN is a separate 6-digit number specifically for your physical card at ATMs and POS terminals. Make sure not to mix them up!

- Q: How long does it take for my GCash card to be activated after linking?

- A: Typically, linking and activation are near-instantaneous once you complete the steps in the app. If you encounter issues, refer to the “Card Not Activated or Linked” section above.

The Takeaway: Don’t Panic, Troubleshoot!

Dealing with a GCash card not working can be annoying, but in most cases, it’s a simple fix. From insufficient balance to a temporary system glitch, knowing the common reasons empowers you to resolve the problem quickly. Remember to always keep your app updated, your account fully verified, and your PINs secure.

I hope this guide helps you get your GCash card working again smoothly. For more tips on managing your digital finances, e-wallets, and mobile banking in the Philippines, keep exploring digitalhelpph.com!