Last Updated on January 9, 2026

Have you been seeing news about SeaBank changing its name? Or maybe you’ve heard the name MariBank mentioned and wondered what it means for your favorite digital bank. I know, big news like this can be a bit confusing and even worrying. Your first question is probably, “Is my money safe?” followed by, “What will happen to my account?” Don’t worry, all your questions will be answered here. This news is a big step for SeaBank, and it’s actually a positive one.

In this comprehensive guide, we’ll break down the official reason for the name change, what you should expect as a user, and why this move is part of a bigger plan. The transition from SeaBank to MariBank is happening, and it’s important to be updated so you know what’s coming next. This article will serve as your go-to resource to understand everything about the big rebrand.

Key Takeaways:

- New Name: SeaBank will be called MariBank Philippines.

- Same Bank: Your account, funds, and services remain the same.

- Official Date: The name change took effect on July 31, 2025 (see official announcement link).

- No Action Needed: You don’t need to open a new account.

- Reason: The change is to align with its parent company’s other brands.

Contents

What’s Happening? The SeaBank to MariBank Rebrand

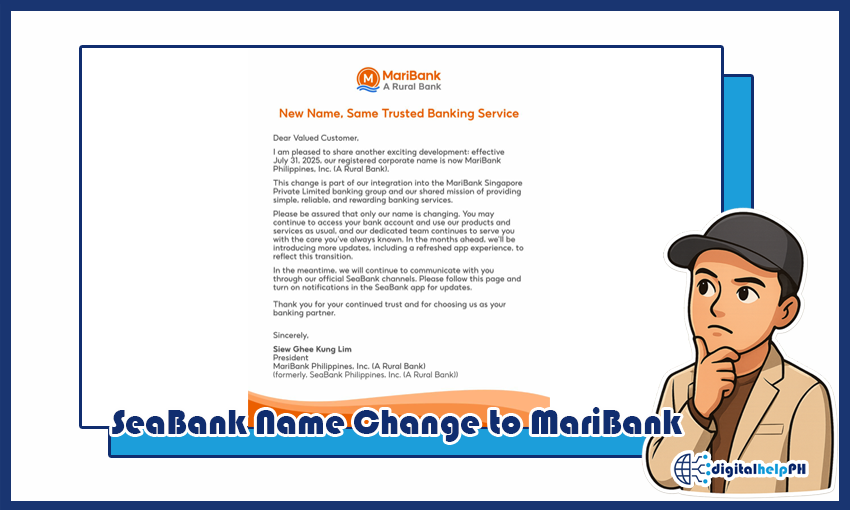

It’s official. SeaBank Philippines, Inc. (A Rural Bank) is now MariBank Philippines, Inc. (A Rural Bank). The name change became effective on July 31, 2025. This is not just a rumor; the name change has been formally approved by the Bangko Sentral ng Pilipinas (BSP) and the Securities and Exchange Commission (SEC). This means that for all official and legal purposes, SeaBank will now operate under the name MariBank.

This move is part of a corporate rebranding effort that has been in the works for a while. You might have seen news about a similar change happening in other countries where the parent company, Sea Limited, operates its digital banking services. This name change is a sign of a more unified brand identity across the region.

Why is the Name Changing?

The main reason for the SeaBank name change is corporate branding. Both SeaBank and MariBank are part of the same parent company, Sea Limited—the same company behind Shopee and Garena. To create a single, recognizable brand for its financial services across different countries, the company has decided to consolidate its digital banking arm under the MariBank name. This move makes the brand more consistent for users and helps it compete more effectively in the international digital banking space.

The change signals a commitment from the parent company to grow its financial services in the Philippines and integrate its products more closely with its popular e-commerce and gaming platforms. Essentially, this rebrand is about strengthening the company’s financial services brand and making it more familiar to a global audience.

What Does This Mean for You, a MariBank User?

This is the most important part! If you’re currently a SeaBank account holder, don’t worry. Your money is still safe, and you can continue to use all the services you’ve grown to love. The official announcement from the bank itself confirms this. Here’s a simple breakdown of what will and won’t change:

- Your Account is Unaffected: You may continue to access your accounts and use all the product and services you’ve come to know. Your existing account number will remain unchanged. You will not need to open a new account.

- Your Funds are Safe: Your money is still safe and insured by the Philippine Deposit Insurance Corporation (PDIC) up to ₱500,000. The name change does not affect this in any way.

- Services and Features: You can still enjoy the same features, including free transfers to other banks via InstaPay and PESONet, free bills payment, and a high-interest rate on your savings.

- A Refreshed App Experience: The company has announced that a refreshed app experience is coming soon. The SeaBank app icon and in-app branding will eventually be updated to reflect the new MariBank name. Just make sure you update your app when prompted.

The key takeaway is that for you, the user, it’s business as usual. The rebrand is a corporate and legal change, not a service disruption.

Frequently Asked Questions:

-

Q: Is it still safe to keep my money in MariBank?

- A: Yes, it is completely safe. The name change is a corporate rebranding, and it does not affect the bank’s stability, security, or its status as a BSP-regulated and PDIC-insured bank. Your funds are protected.

-

Q: Do I need to open a new account with MariBank?

- A: No, you do not need to do anything. Your existing SeaBank account automatically became a MariBank account on July 31. Just continue using the app as you normally would.

-

Q: When will the SeaBank app change to MariBank?

- A: The transition to the new app experience will be done gradually. Expect to see updates to the app icon and branding in the coming months. Make sure you have automatic updates enabled for the app so you get the new branding as soon as it’s rolled out.

Conclusion: A New Name, The Same Trusted Service

The transition from SeaBank to MariBank is a big and exciting development for the digital banking industry in the Philippines. While a name change might feel a little unsettling, it’s a strategic move to unite a global brand and strengthen the bank’s services. Your money, your account, and all the features you rely on are completely safe. This change simply means the bank is aligning itself with a bigger family, promising a more unified and streamlined experience for its users.

Stay updated by following the bank’s official social media pages and by enabling notifications on your app. For more helpful articles on how to use digital banks and e-wallets, be sure to visit digitalhelpph.com for all your digital finance needs.